How to Calculate Beta of a Portfolio

Multiply the percentage portfolio of each stock by its beta value. To calculate the overall beta of a portfolio one has to find out the Beta values of Individual stocks according to the weightage of individual stocks.

Calculate The Beta Of A Portfolio In Excel The Excel Hub Youtube

Our retirement investment approach could help you in this stormy market.

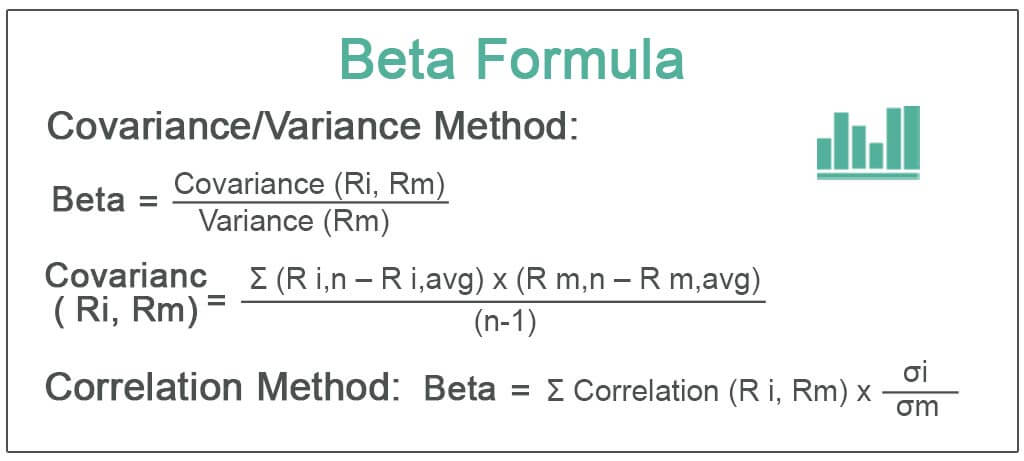

. Makes up 030 of the portfolio and has a beta of 136 then its weighted beta in the portfolio would be 136 x 030 0408. While variance and standard deviation of a portfolio are calculated using a complex formula which includes mutual correlations of returns on individual investments beta. We divide risk into systematic and unsystematic riskThe first relates to the intrinsic stock market risk.

How do you interpret a portfolio beta. In the previous example 1000 plus 5000 equals 6000. Reflects the Beta of a given stock asset and.

Portfolio beta is an important input in calculation of Treynors measure of a portfolio. To calculate a beta portfolio obtain the beta values for all stocks in the portfolio. Portfolio beta is a measure of the overall systematic risk of a portfolio of investments.

Divide each stock investment by the total invested to find the stocks weight. Know how to create a spreadsheet that will capture information at a glance and automatically update your portfolios beta. As mentioned in the beta calculator the beta of a stock or the beta of a portfolio is a value that measures the extra risk we take over the market risk.

Use Excel or spreadsheet software to calculate and recalculate portfolio beta according to market marketplace conditions and other factors. Find the percentages that each stock represents of the whole portfolio. The portfolio beta can be computed by taking a weighted-average of the beta for each stoc.

Hi Guys This video will show you an example how to calculate the Beta for a portfolio You own a portfolio that you have invested 2754 in Stock A 1301 i. While useful it does not accurately explain the portfolios behaviour as the market moves. This measure is not subjective.

To calculate the beta of a portfolio you need to first calculate the beta of each stock in the portfolio. For example if Apple Inc. It represents the risk you cannot mitigate even by.

It equals the weighted-average of the beta coefficient of all the individual stocks in a portfolio. Stock As weight is 1000 divided by 6000 for 01667 and Stock B is 5000 divided by 6000 for a weight of 08333. Therefore as calculated the overall Beta of the above portfolio of 4 stocks the Beta turns out to.

Represents the Beta of the portfolio. This video shows how to calculate the beta of an entire portfolio. Then you take the weighted average of betas of all stocks to calculate the beta of the portfolio.

It equals the weighted-average of the beta coefficient of all the individual stocks in a portfolio. Now if this equation is freaking you out please dont let it freak you out. Ad Unique strategies could help you fight the effects of inflation on retirement investments.

Lets say a portfolio has three stocks A B and C with portfolio weights as 10 30 and 60 respectively. You can calculate Portfolio Beta using this formula. Denotes the weight or proportion invested in stock asset.

Use spreadsheet software to calculate and update your portfolio beta. A beta that is greater than 10 indicates that the securitys price is theoretically more volatile than the. The beta of these three stocks.

Rate this post Beta measures the risk or volatility associated with a certain stock in comparison to the overall volatility of the stock market as a whole. When assessing a companys potential rate of return investors look at its beta. A traditional risk measure employed in the asset-management industry is the market value exposure which represents the notional exposure in percentage allocation of the fund.

Add up the weighted beta numbers of each stock. Add together the amounts invested in each stock to find the total invested. We start with a brief beta definition in stock market context.

Access the stock quote sites to obtain beta values for each stock in the portfolio.

Beta Formula Top 3 Methods Step By Step Examples To Calculate Beta

How To Calculate The Beta Of A Portfolio Youtube

How To Calculate Beta With Pictures Wikihow

0 Response to "How to Calculate Beta of a Portfolio"

Post a Comment